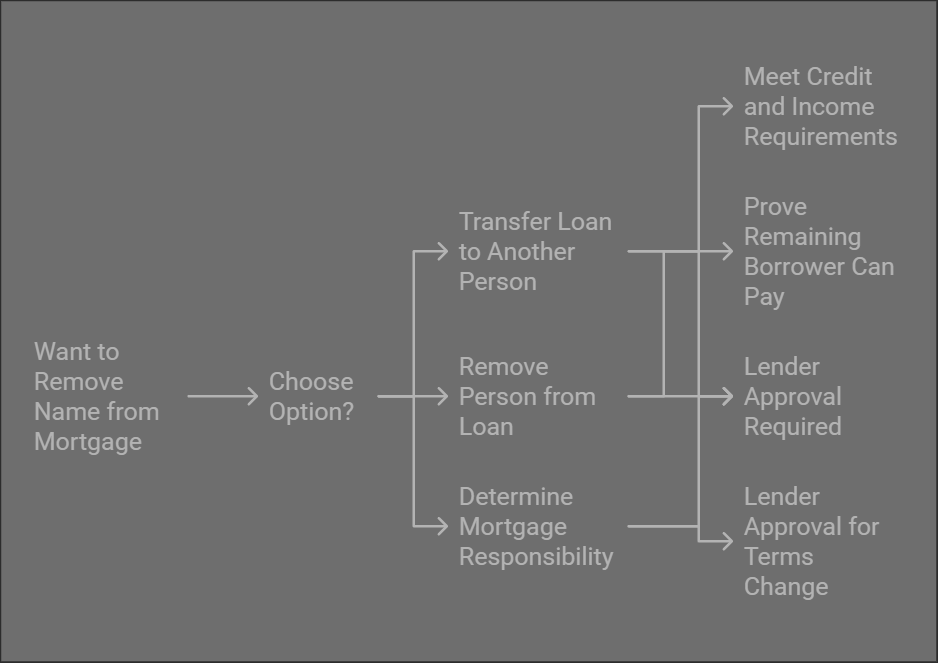

Removing a name from a mortgage without refinancing can be tricky, but it’s not impossible in certain situations.

Here Are the 3 Options:

1. Loan Assumption (Transferring the Loan)

In some cases, one person can take full responsibility for the mortgage without refinancing. This is called a loan assumption. It means transferring the loan to someone else. The lender must approve this, and the person assuming the loan must meet certain credit and income requirements.

2. Release of Liability (Getting Your Name Off the Loan)

A release of liability allows one person to be removed from the loan. This means you’re no longer responsible for the mortgage. However, the lender must agree to this, and you’ll need to prove the other borrower can handle the payments on their own.

3. Divorce Decrees or Court Orders

In some cases, a divorce or court order can determine who stays responsible for the mortgage. While this doesn’t automatically remove the other person’s name from the loan, it may provide a legal path to change the mortgage terms. The lender still needs to approve the change.

Key Considerations:

- Impact on Credit Score: Removing a name could affect both borrowers’ credit scores. If the remaining person struggles with payments, it could hurt their score. Likewise, if the name removal is part of a divorce, it could affect both parties’ scores.

- Legal Concerns: If you’re removing a name due to a divorce, make sure you understand the legal implications. The court order must be clear, and both parties need to ensure the lender approves the change.

Steps to Take:

- Contact Your Lender: Ask about options for removing a name.

- Gather Documents: Prepare proof of income and creditworthiness.

- Review Your Mortgage Terms: Make sure you understand the options the lender offers.

Tips for Negotiating with Lenders:

- Be clear about your intentions and provide all necessary documentation upfront.

- Be prepared to explain how you’ll manage the payments if you’re the remaining borrower.

Checklist for Removing a Name from a Mortgage:

- Contact lender to explore options

- Gather financial documents (income, credit report)

- Understand potential impacts on credit scores

- Discuss the process with a legal advisor (if applicable)

- Get approval from the lender

If you’re considering removing a name from your mortgage, it’s a good idea to understand how this may affect your financial situation. To explore your options and see what fits best with your budget, try using a free used manufactured home mortgage calculator to get a clearer picture.

Refinancing mobile home loans can lower monthly payments or secure better terms. Learn about eligibility, steps, and how refinancing differs from removing a name from a mortgage.

FAQs:

Can I remove a name if we’re getting a divorce?

Yes, but you’ll likely need a court order and lender approval.

What happens if my lender refuses a loan assumption?

You’ll need to consider refinancing or other options.

Does a name removal affect my credit score?

Yes, it could. Both parties’ credit scores may be impacted depending on the payment history and loan assumption.