Non-traditional mortgages offer flexible options for borrowers who may not qualify for standard loans. These mortgages are ideal for unique financial situations, providing alternative paths to homeownership.

Overview of Non-Traditional Mortgage Types

Interest-Only Mortgages

- Key Features: Borrowers pay only interest for an initial period (e.g., 5–10 years). After this, payments include principal and interest.

- Best For: Individuals expecting higher income in the future.

- Risks: Payments may spike significantly after the interest-only period ends.

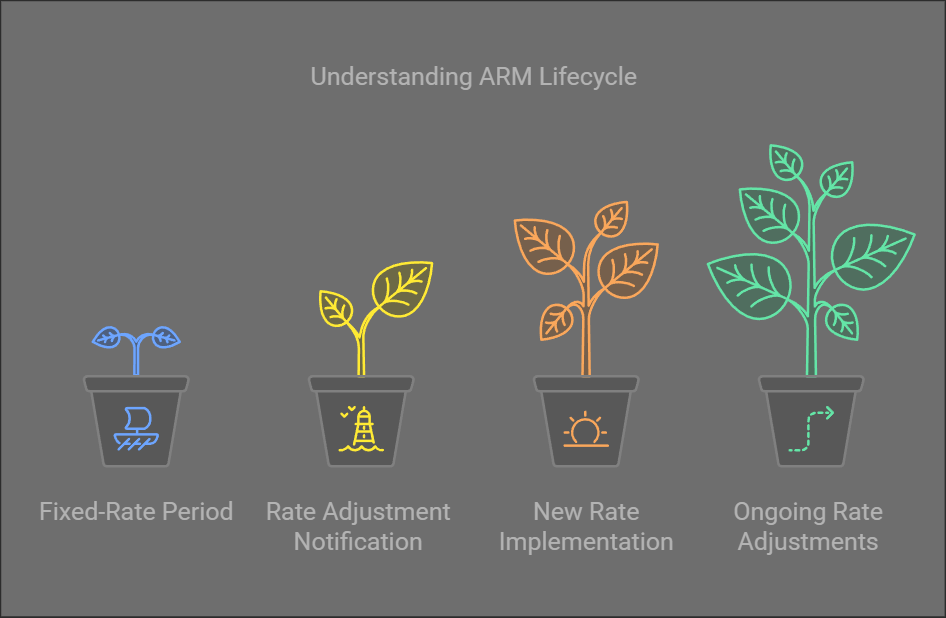

Adjustable-Rate Mortgages (ARMs)

- Key Features: Fixed rate for an initial term (e.g., 5 years in a 5/1 ARM), followed by annual interest rate adjustments based on market trends.

- Best For: Borrowers planning to move or refinance before rate adjustments.

- Risks: Monthly payments can increase significantly due to market fluctuations.

Balloon Mortgages

- Key Features: Lower monthly payments initially, with a lump sum due at the end of the term.

- Best For: Borrowers planning to sell or refinance before the balloon payment is due.

- Risks: Large final payment can create financial strain.

FHA 203(k) Loans

- Key Features: Combines a mortgage and renovation costs into one loan.

- Best For: Buyers of fixer-upper properties who need funds for repairs.

- Risks: Renovation costs might exceed the original budget.

No-Document Mortgages

- Key Features: Limited or no verification of income or assets required.

- Best For: Self-employed individuals or those with irregular income.

- Risks: Higher interest rates and stricter loan terms.

Bridge Loans

- Key Features: Short-term funding to purchase a new home while waiting to sell an existing property.

- Best For: Homeowners in transition.

- Risks: High interest rates and short repayment terms.

Home Equity Conversion Mortgages (HECMs)

- Key Features: Reverse mortgages for homeowners aged 62 or older, allowing access to home equity without monthly payments.

- Best For: Retirees seeking additional income.

- Risks: Decreasing home equity over time.

Shared Equity Mortgages

- Key Features: Borrowers share future home appreciation with lenders or investors in exchange for lower payments or interest rates.

- Best For: Buyers looking to reduce monthly payments.

- Risks: Loss of equity in rising markets.

Here is The Comparision Table:

| Mortgage Type | Key Features | Best For | Risks |

| Interest-Only | Low initial payments; pay interest only for 5-10 years | Future high-income earners | Payment spike after interest-only period ends |

| Adjustable-Rate Mortgage | Fixed rate for initial term; rates adjust annually | Borrowers planning to move or refinance | Monthly payments may increase due to market shifts |

| Balloon Mortgage | Lower initial payments; lump sum due at end | Short-term property owners | Large balloon payment risk |

| FHA 203(k) Loan | Combines mortgage and renovation costs | Buyers of fixer-uppers | Renovation costs may exceed budget |

| No-Document Mortgage | Limited/no income or asset verification | Self-employed or irregular income earners | Higher rates and stricter terms |

| Bridge Loan | Short-term funding for home purchase while selling another | Homeowners in transition | High interest rates and short repayment terms |

| Home Equity Conversion (HECM) | Reverse mortgage for seniors aged 62+ | Retirees seeking additional income | Decreasing home equity over time |

| Shared Equity Mortgage | Borrowers share future home appreciation with lenders | Buyers wanting lower monthly payments | Loss of equity in rising markets |

- Case Study:

- Maria, a freelance graphic designer, used a no-document mortgage to purchase her first home. Despite her irregular income, the flexible approval process helped her secure funding.

- Hypothetical Scenario:

- A borrower with a $200,000 5/1 ARM starts with a 3% fixed rate for the first 5 years. Afterward, the rate adjusts annually, potentially raising or lowering monthly payments based on market conditions.

Detailed Risk Analysis and Mitigation Strategies

- Risk Analysis:

- ARMs: Payments may become unaffordable if interest rates rise.

- Balloon Mortgages: Large final payments may create financial difficulties.

- Shared Equity Mortgages: Property value depreciation impacts borrower and lender equity.

- Mitigation Strategies:

- Build an emergency fund to handle fluctuating payments.

- Seek guidance from a financial advisor before selecting a non-traditional mortgage.