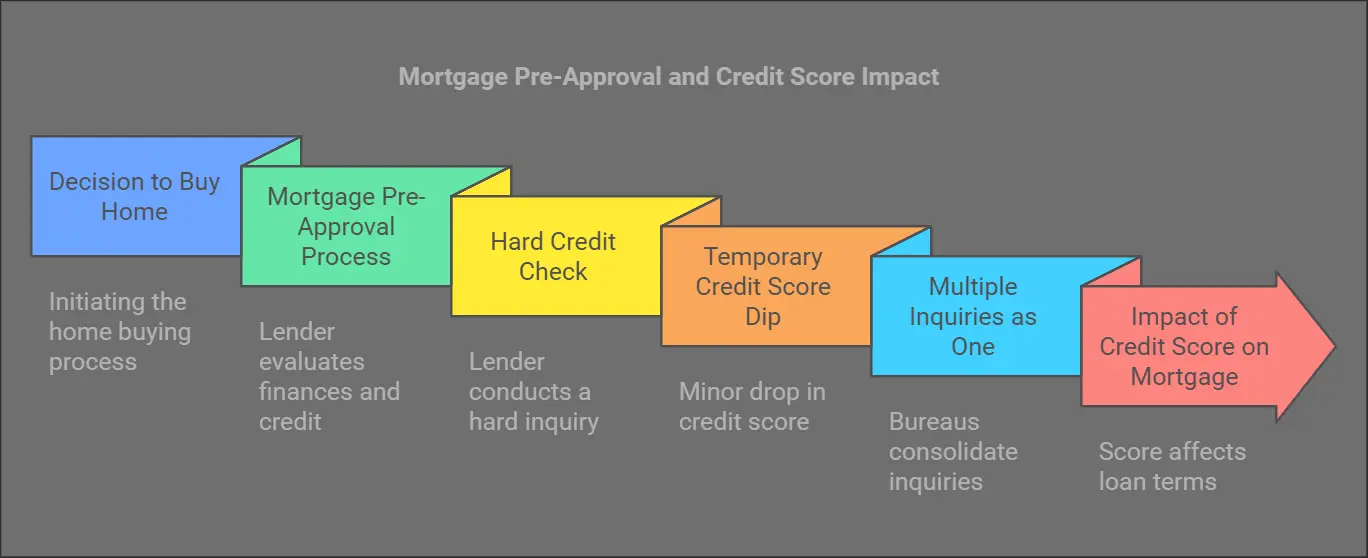

If you’re looking to buy a home, getting pre-approved for a mortgage is a smart first step. It tells sellers you’re serious and financially ready. But does a mortgage pre-approval hurt your credit score?

The short answer: Yes, but just a little—and only temporarily. Don’t worry. The benefits outweigh the small dip in your score.

In this post, we’ll break it down step by step (no confusing jargon, I promise).

What Is a Mortgage Pre-Approval?

Before we talk credit scores, let’s cover the basics:

- A mortgage pre-approval is when a lender checks your finances to see how much home you can afford.

- They look at your credit score, income, and debts.

- Once approved, you get a pre-approval letter showing how much the lender is willing to loan you.

This makes it easier to:

✅ Shop with confidence – You know your budget.

✅ Stand out to sellers – Sellers love serious buyers.

How Does Mortgage Pre-Approval Impact Your Credit Score?

To pre-approve you, lenders run a hard credit check (also called a “hard inquiry”). Here’s what that means:

- A hard inquiry = a small dip in your credit score (usually 5-10 points).

- This dip is temporary and goes away after a few months if you keep your credit healthy.

Why does this happen?

When lenders check your credit, they’re looking to see if you’re a responsible borrower. Too many hard inquiries at once can signal financial stress—so your score takes a minor hit to reflect that risk.

Good News: Multiple Hard Inquiries Won’t Kill Your Score

If you’re shopping for mortgage rates, here’s a big relief:

- Credit bureaus know people shop for mortgages.

- Multiple hard inquiries for a mortgage in a short time count as ONE inquiry.

Tip: Keep your rate shopping within 14-45 days (depending on the credit scoring model). This way, you won’t see multiple hits to your score.

✅ Example: You apply for pre-approval with 3 lenders in 2 weeks. Your score drops only for 1 inquiry—not 3.

How Much Does Your Credit Score Matter for a Mortgage?

Your credit score has a huge impact on your mortgage:

- Higher Credit Score = Lower Interest Rates

- A higher score (700+) can save you thousands of dollars over your loan.

- Lower Credit Score = Higher Interest Rates

- With a lower score (below 620), you’ll still find lenders, but your interest rates may be much higher.

✅ Tip: Check your credit report BEFORE applying for pre-approval. Fix any mistakes or issues to boost your score.

4 Tips to Protect Your Credit Score During Pre-Approval

- Limit Hard Inquiries

- Only apply for pre-approval with lenders you trust.

- Keep Credit Card Balances Low

- Lenders check your credit utilization. Stay below 30% of your credit limit.

- Don’t Take on New Debt

- Avoid car loans, new credit cards, or other big purchases before applying.

- Pay All Bills on Time

- Payment history is the biggest factor in your credit score.

FAQs: Mortgage Pre-Approval and Credit Scores

Does a mortgage pre-approval hurt my credit score?

Yes, but only a little (5-10 points). It’s temporary and worth it.

How long does the pre-approval impact my credit?

A hard inquiry stays on your report for 2 years but only affects your score for a few months.

Can I get pre-approved without hurting my credit?

Some lenders offer “soft credit checks” for pre-qualification—but for a full pre-approval, a hard inquiry is required.

The Bottom Line: Pre-Approval Is Worth It

Yes, a mortgage pre-approval affects your credit score, but only by a little. And that small dip? Totally worth it for the benefits:

✅ You’ll know your budget.

✅ Sellers will take you seriously.

✅ You’ll be ready to act fast when you find your dream home.

If you’re ready to take the next step, use our Manufactured Home Mortgage Calculator to get an estimate of your monthly payments and loan options.