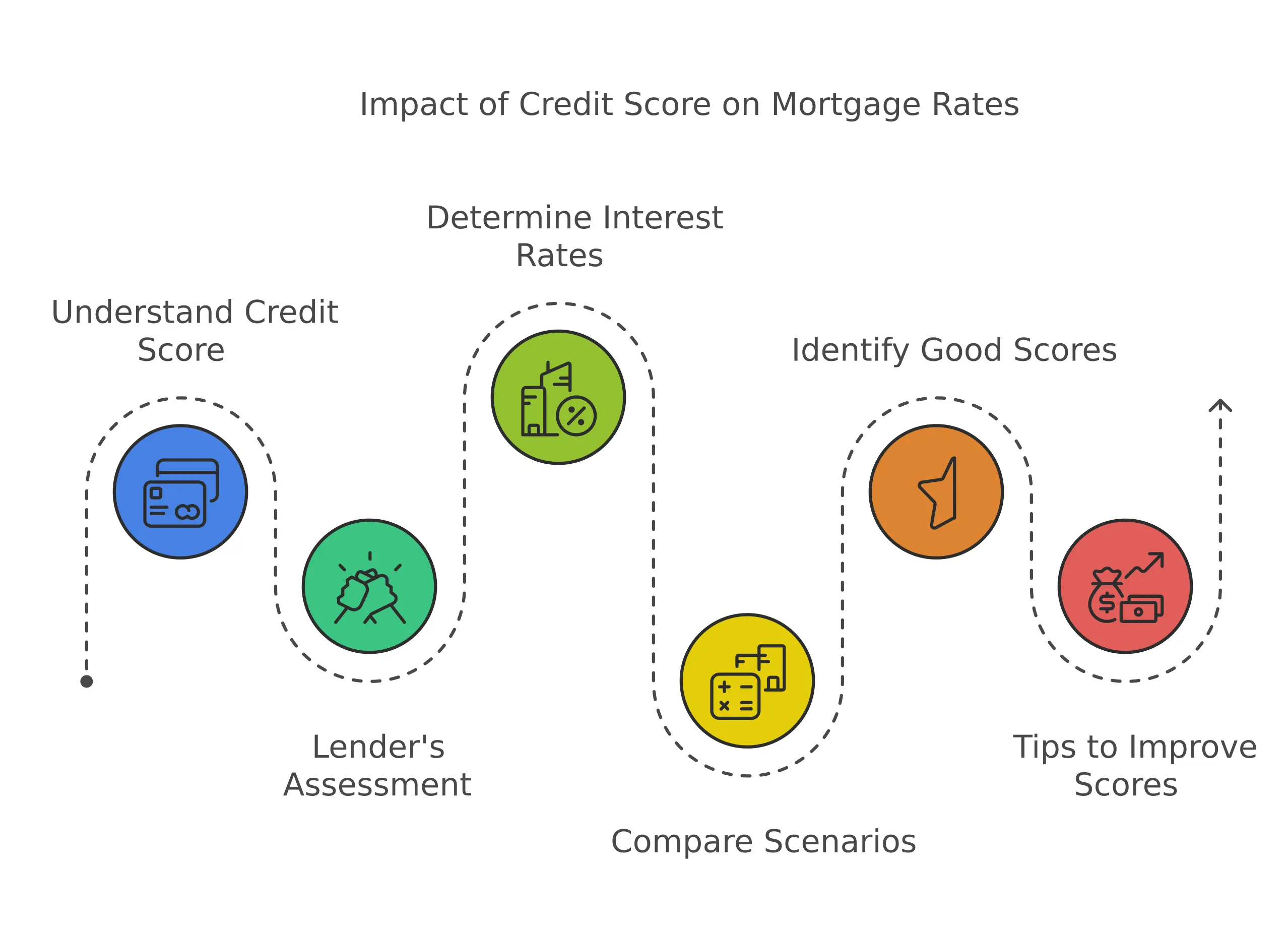

Your credit score isn’t just a number; it’s a key that unlocks better mortgage rates and saves you money. But how exactly does your credit score affect mortgage rates? Let’s break it down in a way that’s simple and easy to understand.

What Is a Credit Score, and Why Does It Matter?

Think of your credit score as a report card for how well you manage money. Lenders use this score to decide if they should trust you with a loan. The higher your score, the more likely they’ll think, “This person is responsible!”

For mortgages, your credit score tells the lender:

- How likely you are to repay the loan.

- How much risk they’re taking by lending you money.

Thinking about financing your manufactured home? Use our manufactured Home mortgage calculator to explore rates and understand how your credit score affects the process.

How Does Credit Score Impact Mortgage Rates?

Here’s the deal: lenders offer better interest rates to people with higher credit scores. Why? Because they see you as less risky.

Let’s compare:

- High Credit Score (750+): Lower interest rates, smaller monthly payments.

- Low Credit Score (below 650): Higher interest rates, bigger monthly payments.

In short, a good credit score can save you thousands of dollars over the life of your loan.

Did you know that applying for a mortgage pre-approval can temporarily impact your credit score? It’s a small price to pay for understanding your borrowing power.

Real-Life Example: Higher Credit Score = Lower Costs

Imagine two people, Alex and Taylor, apply for the same $200,000 mortgage:

- Alex (High Credit Score): Gets a 3.5% interest rate. Monthly payment: $898.

- Taylor (Low Credit Score): Gets a 5.0% interest rate. Monthly payment: $1,074.

Over 30 years, Taylor pays $63,360 more just because of a lower credit score. Ouch!

What’s a Good Credit Score for a Mortgage?

While every lender is different, here’s a general breakdown:

- Excellent (750+): Best rates available.

- Good (700-749): Still great rates.

- Fair (650-699): Acceptable, but not ideal.

- Poor (below 650): Likely to face higher rates or even loan denial.

Tips to Improve Your Credit Score Before Applying

Want better rates? Here are a few easy ways to boost your credit score:

- Pay bills on time: Set reminders or automate payments to avoid late fees.

- Lower credit card balances: Aim to use less than 30% of your credit limit.

- Avoid new debt: Don’t open new credit cards or take out loans right before applying for a mortgage.

- Check your credit report: Look for errors and dispute any mistakes.

Small changes now can lead to big savings later.

FAQs: Quick Answers About Credit Scores and Mortgages

Does credit score impact mortgage rates?

Yes! A higher credit score means lower interest rates and smaller monthly payments.

How much can a good credit score save me?

It can save you tens of thousands of dollars over a 30-year mortgage.

What’s the fastest way to improve my credit score?

Pay down credit card balances and make all payments on time.

Can I get a mortgage with a low credit score?

Yes, but it may come with higher interest rates and stricter terms. Some lenders specialize in bad-credit mortgages, but you’ll likely pay more in the long run.

How do lenders check my credit score?

Lenders request your credit report from major bureaus like Experian, Equifax, or TransUnion. They look at your score, payment history, and credit utilization to assess your risk.

Does applying for a mortgage affect my credit score?

Yes, but the impact is typically small. When a lender performs a hard inquiry, your score might drop by a few points. Shopping for rates within a short period (14–45 days) usually counts as a single inquiry.

What if I don’t have a credit score?

If you don’t have a credit score, lenders may consider alternative data, like your rent payment history, utility bills, or bank statements. However, options may be limited.

How long does it take to improve a credit score?

It depends on your starting point and the actions you take. Paying down debt and fixing errors on your report can boost your score in a few months, while building a solid payment history takes longer.

Do joint applicants need high credit scores?

Lenders usually consider the lower credit score between two applicants. If one person has a significantly better score, it may be worth exploring solo applications.

Are there specific loan programs for people with poor credit?

Yes, FHA loans, VA loans, and USDA loans often have lower credit score requirements, making homeownership accessible to more people.

What’s the difference between a credit score and a credit report?

Your credit score is a numerical representation of your creditworthiness, while a credit report is a detailed record of your financial history. Both are important when applying for a mortgage.

Does closing old credit cards improve my credit score?

Not always. Closing old accounts can reduce your available credit and increase your credit utilization ratio, which could lower your score.

Can I negotiate my mortgage rate even with a low credit score?

Yes! While your credit score plays a big role, factors like your down payment, income stability, and lender competition can also help you negotiate better terms.

The Bottom Line

Your credit score plays a huge role in how much you’ll pay for a mortgage. A higher score means lower rates, smaller payments, and big savings over time. Take steps today to improve your credit, and your future self will thank you!