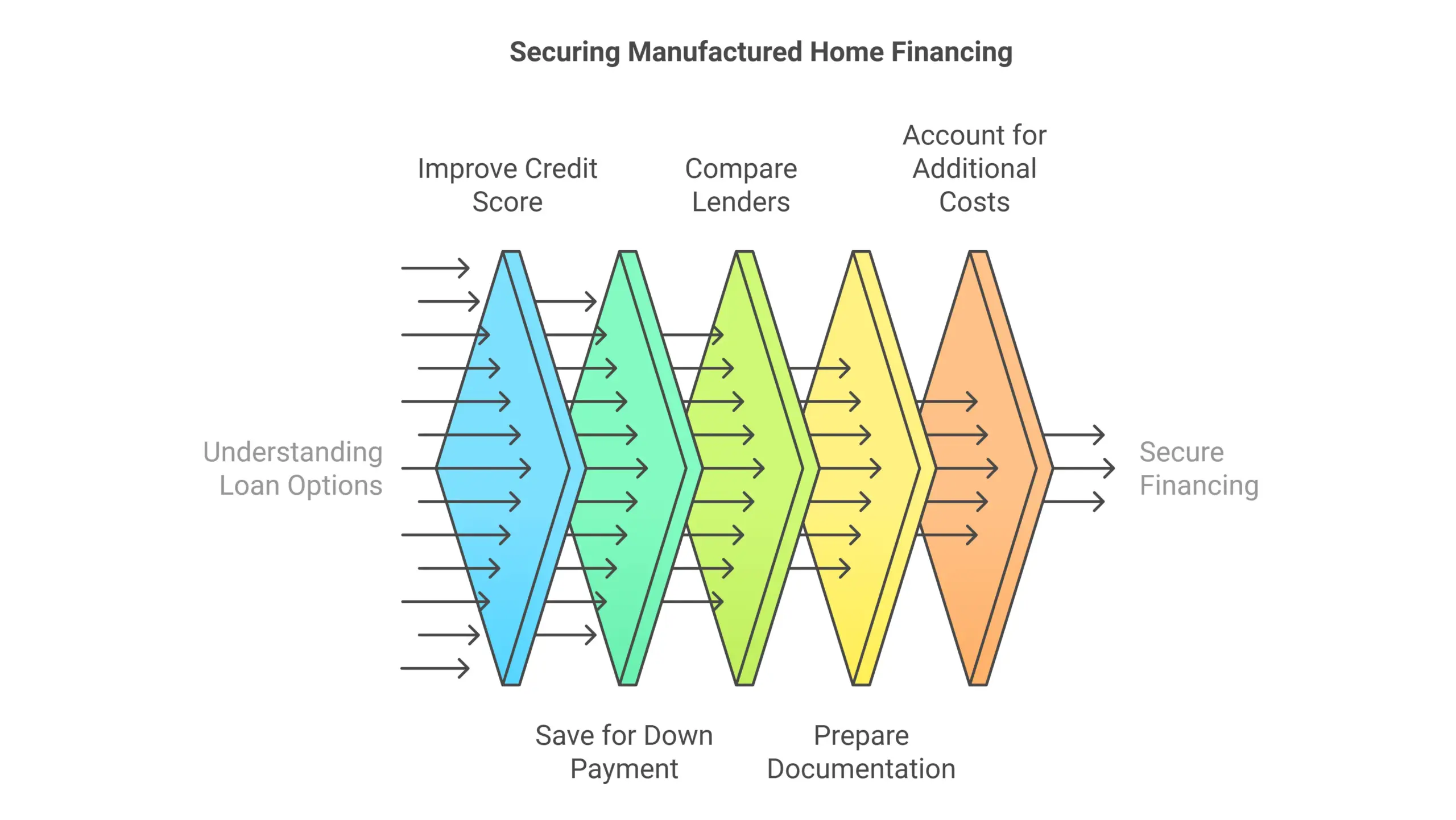

Financing a manufactured home can be simple with the right steps. This guide gives clear tips to help you secure the best loan in 2025.

Here are the 7 Best Manufactured Home Financing Tips:

Tip 1: Understand Your Loan Options

- Loan Types:

- FHA Loans: Low down payments.

- VA Loans: For veterans.

- USDA Loans: For rural housing.

- Chattel Loans: For homes not on land.

- Conventional Loans: For strong credit scores.

- Steps:

- Research loan types.

- Consult with lenders to choose the best option.

Tip 2: Improve Your Credit Score

- Why It Matters:

- Higher scores mean lower interest rates.

- How to Improve:

- Pay debts on time.

- Avoid new credit before applying.

- Check and correct errors on your credit report.

- Goal: Aim for a score of 580 or higher.

Tip 3: Save for a Down Payment

- Benefits:

- Lowers monthly payments and interest.

- How to Save:

- Set automatic savings.

- Cut unnecessary expenses.

- Look for assistance programs.

- Typical Range: 5–20% of the purchase price.

Tip 4: Compare Lenders

- Why Compare:

- Better rates and terms.

- Key Factors:

- Interest rates.

- Loan terms.

- Fees and closing costs.

- Steps:

- Use comparison tools.

- Get pre-approval from multiple lenders.

Tip 5: Use a Mortgage Calculator

- Benefits:

- Estimate payments.

- See how rates and terms affect costs.

- Tool: Use our Manufactured Home Mortgage Calculator.

Tip 6: Prepare Your Documentation

- What You Need:

- Proof of income.

- Credit history.

- Property details.

- Steps:

- Create a checklist.

- Organize digital and physical copies.

Tip 7: Account for Additional Costs

- Extra Expenses:

- Insurance: Homeowners and flood coverage.

- Maintenance: Repairs and upkeep.

- Taxes: Property taxes.

- Park Agreements: Review rules if living in a mobile home park.

- Advice: Budget for these costs before finalizing your loan.

Tip 8: Check Home Eligibility

- Requirements:

- Home age: Some lenders have limits.

- Condition: Must meet lender standards.

FAQs

What type of loan is best for a manufactured home?

- FHA, VA, USDA, or conventional loans are common options. The best choice depends on your financial situation.

Is it harder to finance a manufactured home?

- Financing can be challenging due to stricter requirements, but good credit and a down payment improve your chances.

What is a method for financing manufactured homes?

- Options include chattel loans, FHA loans, VA loans, USDA loans, and conventional loans.

What is the average loan term for a manufactured home?

- Loan terms usually range from 15 to 30 years.

Conclusion

By improving your credit, saving for a down payment, and researching lenders, you can secure affordable financing for your manufactured home in california. Use our Manufactured Home Mortgage Calculator to start planning today.