Quickly estimate your monthly manufactured home mortgage payment by Use our Free Tool.

Follow these simple steps:

How to Use the Calculator

- Input Loan Amount: Enter the total amount you plan to borrow.

- Select Interest Rate: Choose an estimated annual interest rate based on current market rates or your lender’s offer.

- Set Loan Term: Select the desired repayment term, such as 15, 20, or 30 years.

- Review Your Results: The calculator will estimate your monthly payment, covering principal and interest.

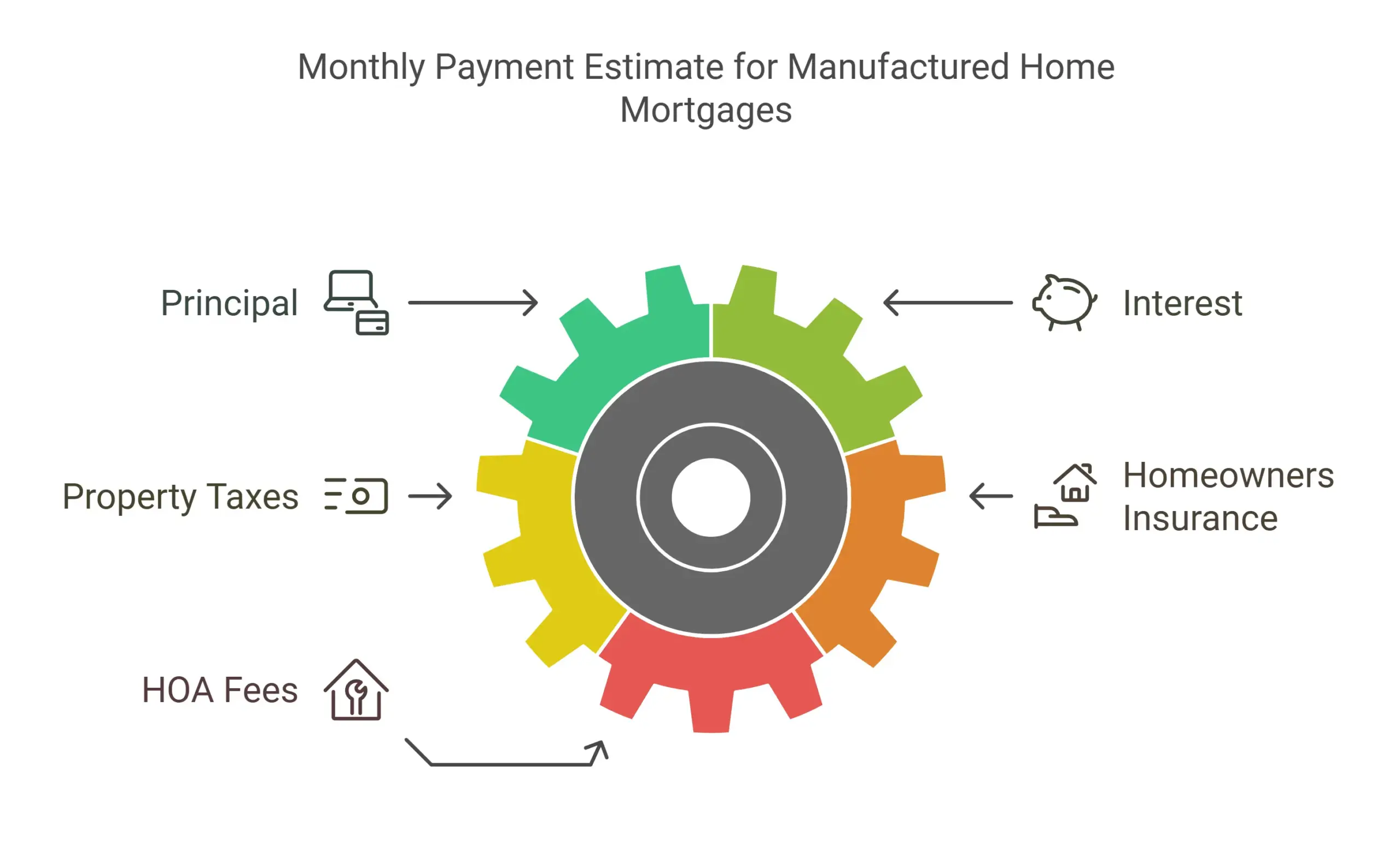

What’s Included in Your Monthly Payment

- Principal: The original loan amount you borrowed.

- Interest: The cost charged by the lender for borrowing money.

What’s Not Included

- Property Taxes: These vary by location and are paid annually.

- Homeowners Insurance: Protects your property and is typically required by lenders.

- HOA Fees: If applicable, these cover community maintenance and amenities.

Tips to Lower Your Monthly Payment

- Make a Larger Down Payment: A higher down payment reduces your loan balance and interest.

- Select a Shorter Loan Term: Shorter terms may have higher monthly payments but lower interest costs over time.

- Improve Your Credit Score: Higher credit scores often qualify for better interest rates.

Benefits of Using the Calculator

- Save time by getting instant estimates.

- Plan your budget confidently before applying for a loan.

- Compare loan options to find the best fit for your needs.

Bi-monthly mortgage payments involve splitting your monthly payment into two equal parts, paid every two weeks. This method reduces interest over time and helps pay off your loan faster.

People Also Ask

How do I calculate a monthly mortgage payment?

Use this formula:

M = P [i(1 + i)^n] / [(1 + i)^n – 1]

- M = Monthly payment

- P = Loan amount (principal)

- i = Monthly interest rate (annual rate ÷ 12)

- n = Total number of payments (loan term in years × 12)

Or use our online calculator for a faster and easier estimate.

What is the monthly payment on a $300,000 mortgage for 30 years?

For a $300,000 loan at a 6% interest rate:

- Loan term: 30 years

- Monthly payment (principal and interest): $1,799.62

(Excludes property taxes, insurance, and other costs.)

How much is a $400,000 mortgage payment for 30 years?

For a $400,000 loan at a 5.5% interest rate:

- Loan term: 30 years

- Monthly payment (principal and interest): $2,271.16

(Excludes taxes, insurance, and fees.)

What would a $500,000 mortgage cost per month?

For a $500,000 loan at a 7% interest rate:

- Loan term: 30 years

- Monthly payment (principal and interest): $3,326.51

Costs will vary based on down payment, taxes, and insurance.