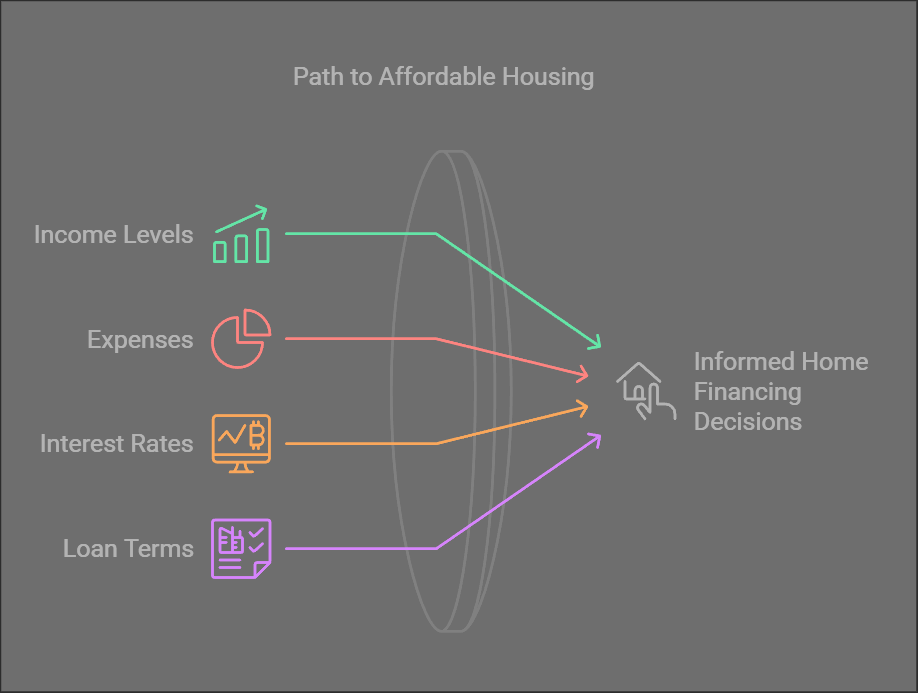

Understanding affordability is essential for making informed home financing decisions. Let’s dive into two key metrics:

- Debt-to-Income Ratio (DTI): How much of your income goes toward debt payments.

- Housing Expense Ratio: The percentage of income spent on housing costs.

Debt-to-Income Ratio (DTI)

DTI measures the percentage of your gross monthly income used for debt payments. This includes:

- Mortgage payments

- Auto loans

- Credit card balances

- Student loans