Yes! Refinancing a mobile home loan can help you save money, improve your loan terms, or access cash for major expenses. It involves replacing your existing loan with a new one, often at a lower interest rate or better repayment terms.

Refinancing your mobile home loan is a powerful tool for reducing costs and gaining financial flexibility. Whether you’re considering lowering your monthly payments or exploring a cash-out option, understanding your loan type is key. Use our manufactured homes calculator to estimate potential savings and see how refinancing could benefit your budget.

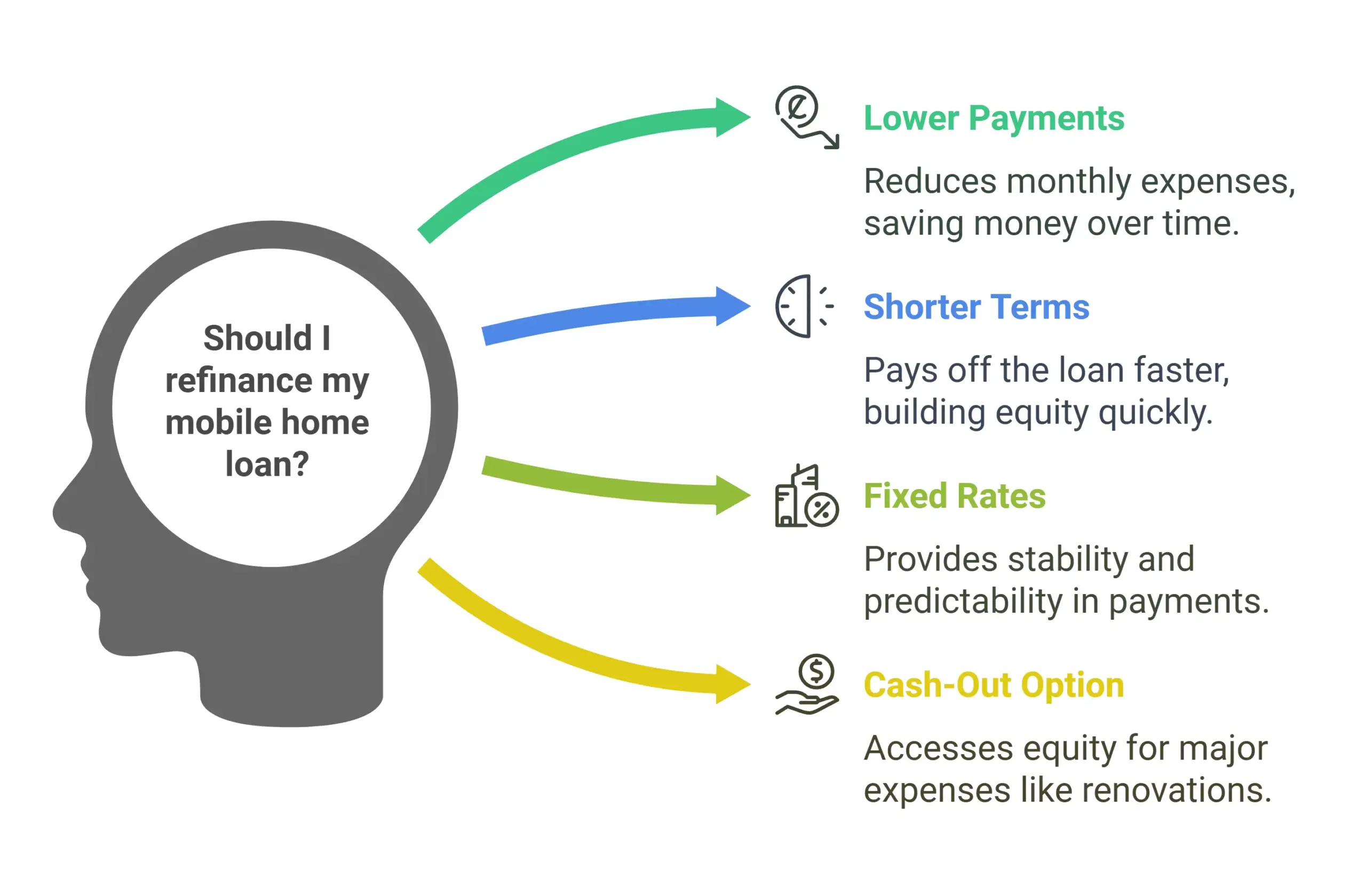

Benefits of Refinancing a Mobile Home Loan

- Lower Monthly Payments

Refinancing at a reduced interest rate can make your monthly payments more affordable, helping you save over time. - Shorter Loan Terms

Pay off your loan faster, build equity quicker, and potentially save on interest costs in the long run. - Fixed Interest Rates

If your current loan has a variable rate, refinancing to a fixed rate can offer stability and predictability in your payments. - Cash-Out Option

Unlock the equity in your mobile home to fund renovations, pay off high-interest debt, or cover significant expenses.

Types of Mobile Home Loans and Refinancing Options

1. Chattel Loans

- Secured by the mobile home only (not the land).

- Refinancing can lower your interest rate, though chattel loans usually have higher rates than real estate loans.

2. Real Estate Loans

- Secured by the mobile home and the land it occupies.

- Refinancing typically offers better terms, such as longer repayment periods or lower, fixed rates.

How Loan Types Impact Refinancing

- Real Property Loans: If your mobile home is titled as real property, you’ll likely qualify for lower interest rates and better refinancing options.

- Personal Property Loans: While refinancing options for chattel loans may be more limited, you could still benefit from a rate reduction or improved terms.

Tax Implications of Refinancing

- Mortgage Interest Deduction

If your mobile home is classified as real property, you might be able to deduct interest paid on your refinanced loan. - Cash-Out Refinance Taxes

Funds from a cash-out refinance are typically not taxable since they aren’t considered income.

💡 Always consult a tax professional to understand how refinancing could affect your specific situation.

Real-Life Refinancing Scenarios

Lower Monthly Payments

- Before Refinancing: $80,000 loan at 8% interest over 20 years. Monthly payment: $668.

- After Refinancing: $80,000 loan at 5% interest over 20 years. Monthly payment: $528.

- Savings: $140/month or $33,600 over the loan term.

Cash-Out Refinance Example

- Current Home Value: $100,000.

- Remaining Loan Balance: $50,000.

- New Loan: $70,000 at 5% interest.

- Cash Accessed: $20,000 for renovations, debt repayment, or other needs.

FAQs About Mobile Home Refinancing

Is refinancing a mobile home difficult?

Refinancing may be more challenging if your home is titled as personal property or doesn’t meet HUD compliance. However, many options are available for eligible properties.

Can I access equity from my mobile home?

Yes! A cash-out refinance allows you to tap into your home’s equity for renovations, debt consolidation, or other expenses.

Why are mobile home mortgages harder to obtain?

Mobile homes not classified as real property or those without permanent foundations often face stricter lending requirements, limiting available options.

What credit score is required to refinance?

Most lenders require a credit score of at least 620, although some may accept lower scores depending on other factors like income and loan-to-value ratio.

Conclusion:

Refinancing your mobile home loan can be a smart financial move. Whether you’re looking to lower monthly payments, pay off your loan faster, or access cash, evaluating your options carefully can help you make the most of your refinancing journey.

you’re seeking inspiration for financial independence, the show How to Live Mortgage Free with Sarah Beeny offers invaluable tips and real-life examples of people who have achieved mortgage-free living. Each episode dives into creative strategies for reducing housing costs, from building tiny homes to renovating unconventional spaces. Explore our detailed guide on the episodes here, and discover how you can take steps toward a mortgage-free lifestyle.