Can You Get a Reverse Mortgage on a Manufactured Home? As retirement approaches, many homeowners explore financial options to make the most of their home equity. A reverse mortgage is one such solution, enabling seniors to convert part of their equity into cash without the burden of monthly payments. Here’s what you need to know about reverse mortgages for manufactured homes.

What is a Reverse Mortgage?

A reverse mortgage is a loan available to homeowners aged 62 or older. It allows you to access your home equity without making monthly mortgage payments. Instead, the loan is repaid when the home is sold, the homeowner moves, or they pass away.

Can You Get a Reverse Mortgage on a Manufactured Home?

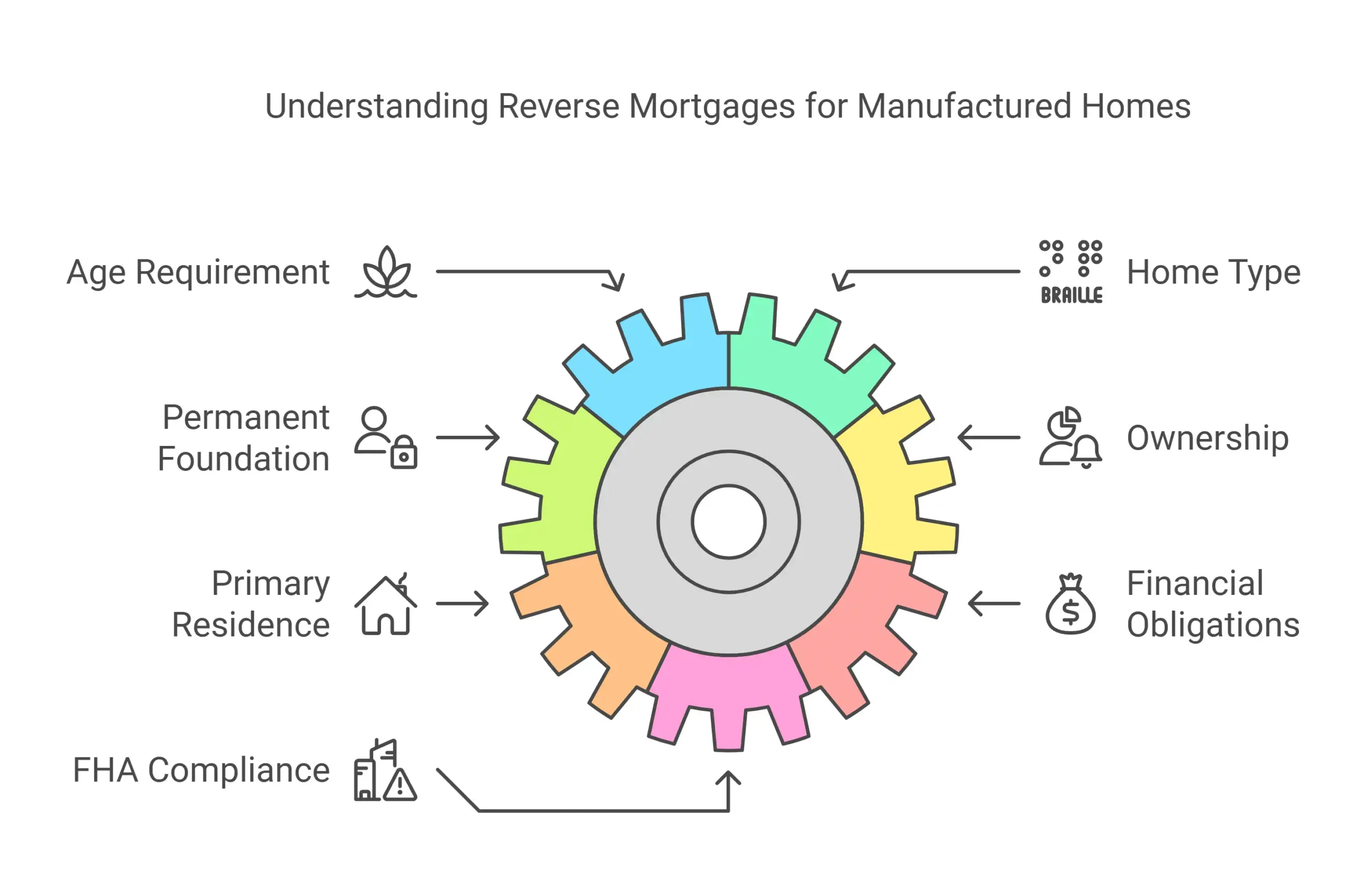

Yes, but specific eligibility requirements apply:

- Age Requirement: All borrowers must be at least 62 years old.

- Home Type: The manufactured home must have been built after June 15, 1976, and meet HUD safety and quality standards.

- Permanent Foundation: The home must be permanently affixed to a foundation and classified as real property.

- Ownership: You must own the property outright or have a low remaining mortgage balance that can be paid off with the reverse mortgage.

- Primary Residence: The home must be your primary residence.

- Financial Obligations: Property taxes, insurance, and maintenance expenses must remain current.

- FHA Compliance: The home must meet FHA appraisal and inspection standards.

Benefits of a Reverse Mortgage for Manufactured Homes

Reverse mortgages offer several advantages, especially for seniors living in manufactured homes:

- Additional Income: Supplement your retirement income for daily living or unexpected costs.

- No Monthly Payments: Eliminate monthly mortgage payments, easing financial stress.

- Stay in Your Home: Access your home’s equity while continuing to live in it.

Important Considerations

While reverse mortgages can provide financial relief, it’s crucial to weigh the potential drawbacks:

- Upfront Costs: Origination fees, closing costs, and mortgage insurance can add up.

- Inheritance Impact: The loan must be repaid, which may reduce the estate’s value.

- Financial Assessment: You must demonstrate your ability to cover property-related expenses like taxes and insurance.

Conclusion

A reverse mortgage can be a practical financial solution for seniors living in manufactured homes, provided the eligibility criteria are met. By understanding the benefits and considerations, homeowners can make an informed decision that aligns with their retirement goals.

Next Steps

If you’re considering a reverse mortgage for your manufactured home, consult with a HUD-approved lender. They can confirm your eligibility and guide you through the process tailored to your specific property.

This manufactured home mortgage calculator tool can unlock the equity in your home, providing greater financial flexibility during retirement.